washington county utah sales tax

435 634-5703 Send a Message. One of a suite of free online calculators provided by the team at iCalculator.

Wenatchee Wa You Will Always Be Home To Me Dear Wenatchee So Beautiful West Coast Road Trip Washington State Travel Beautiful Places To Live

If you need access to a database of all Utah local sales tax rates visit the sales tax data page.

. 3 rows Washington County UT Sales Tax Rate The current total local sales tax rate in. We want the content of our website to be timely and useful to you. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

The current total local sales tax rate in Washington UT is 6750. 2021 Tax Sale. B Preferred Sale is the sale of a single designated parcel.

The 675 sales tax rate in Washington consists of 485 Utah state sales tax 035. Notice is hereby given that on May 23 2019 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. Treasurer stops accepting redemption payments for properties listed for sale. Utah has state sales tax of 485 and.

The Washington County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Washington County Utah in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Washington County Utah. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Washington County UT at tax lien auctions or online distressed asset sales. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

Yearly median tax in Washington County. This is the total of state and county sales tax rates. 2020 Tax Sale.

Utah is ranked 1131st of the 3143 counties in the United States in order of the. George UT 84770 Phone. The County Assessor is responsible for listing and valuing all taxable real and personal property in Washington County.

Criteria for Granting Bidder Preference. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Washington County CoCity 27000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option Liquor Restaurant Sales Short-term Leasing Transient Room Addl Transit. The Utah state sales tax rate is currently.

Has impacted many state. Average Sales Tax With Local. 6 rows The Washington County Utah sales tax is 605 consisting of 470 Utah state sales tax.

Utah County Ordinance 21-5-8 states the following. If you dont find what you need here please let us know. The median property tax in Washington County Utah is 1231 per year for a home worth the median value of 240900.

Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales taxClick any locality for a full breakdown of local property taxes or visit our Utah sales tax calculator to lookup local rates by zip code. These buyers bid for an interest rate on the taxes owed and the right to. Thursday May 19 2022 - Live Auction Limited Sale of Delinquent Properties - Preferred Bid and Undivided Interest Sales Only.

The December 2020 total. See how we can help improve your. The Washington County sales tax rate is.

Notice is hereby given that on May 20 2021 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale. Washington County collects on average 051 of a propertys assessed fair market value as property tax. 2019 Tax Sale.

Washington County UT currently has 174 tax liens available as of February 11. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. The Washington County Treasurers office is pleased to offer a range of helpful information for the taxpayers of Washington County.

Tom Durrant 87 North 200 East STE 201 St. A county-wide sales tax rate of 16 is. The 2018 United States Supreme Court decision in South Dakota v.

051 of home value. Utah County ClerkAuditor - Tax Sale Location. Notice is hereby given that on May 28 2020 at 1000 AM Kim Hafen Clerk-Auditor will offer for sale unless redeemed prior to sale at public auction pursuant to the provisions of section 59-2-1351 Utah Code the described real estate situated in said county and now held by it under preliminary tax sale.

21 rows The Washington County Sales Tax is 16. Washington County in Utah has a tax rate of 605 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Washington County totaling 01. A At the discretion of the County Auditor a parcel of real property may be offered as a Preferred Sale to bidders who are granted Preferred Bidder Status as provided for herein.

The various taxes and fees assessed by the DMV include but are.

Utah Sales Tax Rates By City County 2022

Washington County Utah Bans Unhosted Short Term Rentals

Washington County Board Of Realtors Adobe Style Homes Adobe Home Home

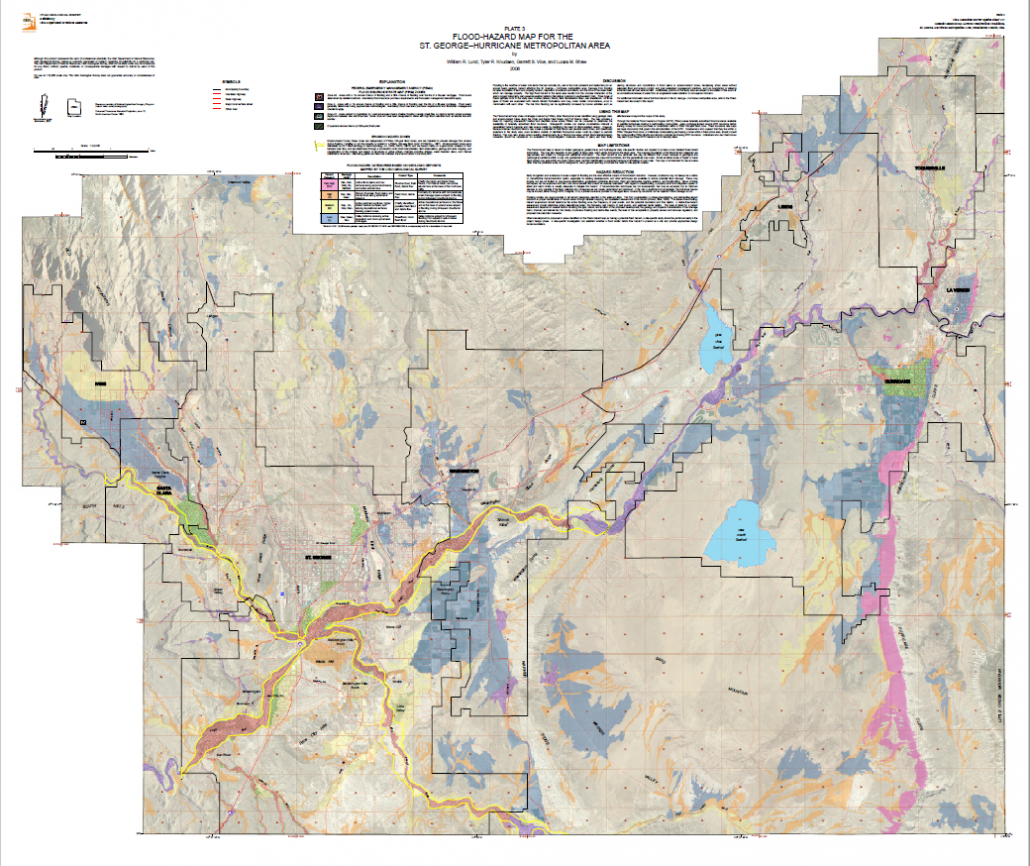

Geologic Hazard Maps For St George Hurricane Area Utah Geological Survey

Silver Reef Washington County Reef Utah

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Retirement Nextadvisor With Time Best Places To Retire Places Zion National Park

Residential Exemption Washington County Of Utah

How Healthy Is Washington County Utah Us News Healthiest Communities

Geologic Hazard Maps For St George Hurricane Area Utah Geological Survey

Utah Sales Tax Small Business Guide Truic

Payment Options Washington County Of Utah

Pin On Salt Lake City Medical Malpractice Lawyer

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Gooseneck State Park Between Monument Valley Bluff Utah State Parks Usa Utah State Parks State Parks